Online Trading With Exness: Unlock Your Trading Potential

Online trading has revolutionized the way individuals participate in financial markets. Among various trading platforms, Exness stands out due to its user-friendly interface, advanced trading tools, and exceptional customer support. This article delves into the essential components of online trading with Exness, helping you navigate your way to potential trading success. Additionally, if you are looking for guidance on the platform, you can find an informative Online Trading With Exness https://mire.cm/2025/02/exness-metatrader-4-instrucciones-de-descarga-e-13/ that explains how to download and set up MetaTrader 4 for use with Exness.

Understanding Online Trading

Online trading refers to the buying and selling of financial instruments through an internet-based platform. This form of trading allows individuals to participate in various markets, including forex, cryptocurrencies, stocks, commodities, and indices. In recent years, the popularity of online trading has surged, driven by technological advancements and the desire for financial independence. Traders can access global markets from virtually anywhere, making it more accessible than ever before.

Why Choose Exness for Online Trading?

Choosing a reputable trading platform is crucial for your trading success. Here are several reasons why Exness is a popular choice among traders:

- User-Friendly Interface: Exness offers an intuitive and easy-to-navigate interface, making it suitable for both beginners and experienced traders. The platform provides access to a wide range of trading tools and resources, helping users make informed trading decisions.

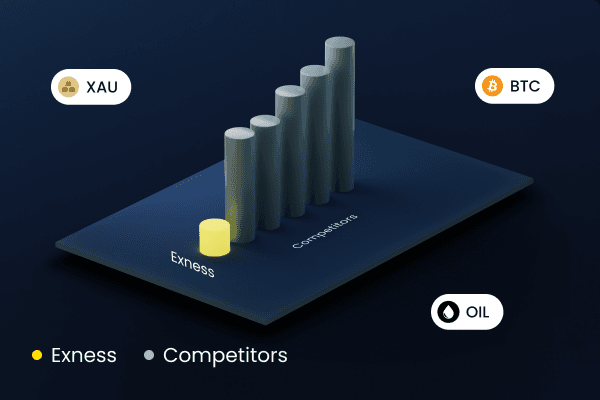

- Variety of Trading Instruments: With Exness, you can trade numerous financial instruments, including forex pairs, commodities, indices, and cryptocurrencies. This variety allows traders to diversify their portfolios and explore different opportunities.

- Low Spreads and Leverage: Exness provides competitive spreads and high leverage, allowing traders to maximize their potential profits. This is especially beneficial for those looking to engage in scalping and day trading strategies.

- Robust Customer Support: Exness is known for its excellent customer service. The support team is available 24/5, helping traders with their inquiries and ensuring a smooth trading experience.

Getting Started with Exness

Starting your trading journey with Exness is straightforward. Follow these steps to get started:

- Register an Account: Visit the Exness website and sign up for a trading account. You will need to provide your personal information and complete the verification process.

- Choose Your Account Type: Exness offers various account types, including Standard, Pro, and ECN accounts. Choose an account that aligns with your trading strategy and experience level.

- Fund Your Account: Deposit funds into your account using one of the many available payment methods. Exness supports multiple payment options, including bank transfers, credit/debit cards, and e-wallets.

- Download Trading Software: Exness supports popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Download the platform of your choice to start trading.

- Start Trading: Once your account is funded and you have downloaded the trading software, you can begin trading. Start by researching market trends and developing a trading plan.

Key Trading Strategies

To succeed in online trading, it’s essential to develop effective trading strategies. Here are some popular strategies that traders commonly use on the Exness platform:

- Day Trading: This strategy involves buying and selling financial instruments within the same trading day, aiming to capitalize on short-term price movements.

- Swing Trading: Swing traders hold positions for several days or weeks, taking advantage of price swings in the market. This strategy requires a good understanding of technical analysis.

- Scalping: Scalping involves making numerous small trades throughout the day, aiming for small profits on each trade. This strategy requires a quick decision-making process and a reliable internet connection.

- Position Trading: Position trading involves holding onto a financial instrument for an extended period, typically several weeks or months, based on long-term trends.

Risk Management in Trading

Risk management is a critical aspect of successful trading. Without proper risk management, traders can face significant losses. Here are some essential risk management techniques:

- Use Stop-Loss Orders: Setting stop-loss orders can help limit potential losses by automatically closing a trade at a predetermined price.

- Diversify Your Portfolio: Spread your investments across different financial instruments to reduce the risk associated with a single asset.

- Position Sizing: Determine the appropriate amount of capital to risk on each trade. A common rule is to risk no more than 1-2% of your trading capital on a single trade.

- Educate Yourself: Continuously educate yourself about market trends, trading strategies, and risk management techniques to improve your trading skills.

Conclusion

Online trading with Exness offers a wealth of opportunities for traders seeking to explore the financial markets. By understanding the features of the platform, implementing effective trading strategies, and practicing risk management, you can enhance your trading experience and increase your chances of success. Whether you are a novice or an experienced trader, Exness provides the tools and resources necessary to help you achieve your trading goals.