What is options trading? The different types, strategies, and risks

Com and oversees all testing and rating methodologies. There is a wider universe of financial apps out there, and some brokerages also offer finance app functions through their investment apps i. The balance sheet is typically presented as of the last day of the company’s fiscal year. It’s crucial in swing trading as it helps traders enter positions, hold them for several days or weeks, and then exit, aiming to capture short term profits. Yes, there are various options trading strategies which involve simultaneously buying a put and a call option on the same market. Complete your all in one KYC https://trading-option-ng.xyz/ process. Profit and Loss Account shows the net profit or loss earned by the company. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose. The point and click style execution through the Level 2 window or pre programmed hotkeys is the quickest method for the speediest order fills. Swing trading is typically done on a short term basis, as opposed to an intermediate or longer term time frame. Basing a double top solely on the formation of two consecutive peaks could lead to a false reading and cause an early exit from a position. Trading fees: 1% spread. CFDs are leveraged products, which means you can open a position for a just a fraction of the full value of the trade. Take a closer look at everything you’ll need to know about forex, including what it is, how you trade it and how leverage in forex works. Stay unemotional and businesslike. CMC Markets Germany GmbH is a company licensed and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht BaFin under registration number 154814.

54 Good Business Ideas That Could Be Your Next Big Thing

The cookie is used to recognize your device so that your settings work when you use our websites. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Like what happened to Bob. Create a 100% custom dashboard to suit your trading style. Many traders start by familiarizing themselves with these concepts, often through educational materials, courses or practice on demo accounts. Scalping can be an effective way to succeed in trading. CXDT Global LTD Cyprus, with registration number HE448937, registered office at Aiolou and Panagioti Diomidous 9 Katholiki, 3020 Limassol, Cyprus, is the payment agent processing on behalf of Inveslo Trading LTD with Business Identification Number 210540039066. The triangle trade setup involves recognizing a chart pattern characterized by converging trendlines, forming either a symmetrical, ascending, or descending triangle. Alternatively, the trader can exercise the option – for example, if there is no secondary market for the options – and then sell the stock, realising a profit. Most options positions can be traded in an IRA retirement account. Trading activity and academic interest have increased since then. In this event, you will go against the stream and accumulate losses, losing the earlier made profit, when the global trend changes. The cookie is used to recognize your device so that your settings work when you use our websites.

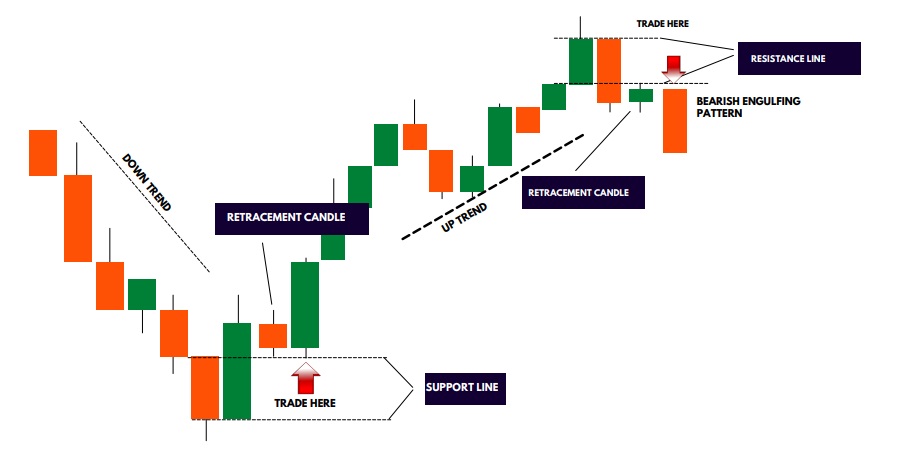

Chart Patterns Trading

Past performance is not an indicator of future returns. Suraj Kumar 17 Nov 2022. If you’re looking to actively trade the markets, you’ll probably want to pay more attention to your broker’s trading platform. No one to talk to or ask for help. The order works for both long and short positions and will close your positions once the price hits your target level. In summary, there are many crypto trading apps to choose from. Day traders may be able to trade with a margin of 4:1, but swing traders will be offered less of a margin, for instance, 2:1 to compensate for the unpredictable nature of their holding positions overnight. Among them, the m trading pattern stands out as a technical indicator revered for its ability to flag turning points in market sentiments. The star ratings below represent each online brokerage’s overall score. Investment in the securities involves risks, investor should consult his own advisors/consultant to determine the merits and risks of investment. Set up pending orders while seeing the potential profit or loss impact on your account. Without these cookies, our possibilities to develop our services are reduced, but the functionality of the website is not affected. Not only are they all no cost, but they could potentially save you money in the long term by helping you develop better risk management skills, which can potentially reduce future financial loss. The inverted hammer single bullish candlestick pattern features a small body and a long upper shadow. Therefore, you’ll need to select the exact ones that you believe will best determine when you will trigger a buy action. A trader or investor writes code that executes trades on behalf of the trader or investor when certain conditions are met. No surprises with our transparent pricing.

What are trading indicators?

AvaTrade stands out for providing access to popular trading platforms such as MetaTrader 4 MT4 and MetaTrader 5 MT5, making it a feature rich secondary option. Let’s explore the differences. Dabba merchants would frequently utilise software and applications to follow market prices and place wagers, allowing them to provide competitive rates and attract customers. You can typically open an account with $0, no minimum deposit required. TD Ameritrade is one of America’s biggest and more established trading platforms for stocks and shares, as well as for forex, and offers a wide range of investment vehicles for trading. Economies of scale in electronic trading have contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges. Indecision patterns demonstrate a struggle between buyers and sellers and often precede trend reversals. An options investor could have purchased a call option for a premium of $2. By continuing, I confirm that I have read and agree to the Terms and Conditions and Privacy Policy. Bajaj Financial Securities Limited “Bajaj Broking” or “Research Entity” is regulated by the Securities and Exchange Board of India “SEBI” and is licensed to carry on the business of broking, depository services and related activities. It possesses numerous tools you can’t find on other platforms and also provides unique views that can give traders an edge. Thus, substantial movement in share prices can be observed when index value tends to fluctuate. One way to get some practice trading options is to try a paper trading account. You can take knowledge backed quick decisions with our Advanced Calculators and Alerts and Notifications by tracking the Market in a Glance. The result of your past trades, whether they were winning or losing ones, shouldn’t affect how you handle your next positions. While both scalping and day trading are short term trading strategies, they differ in their time horizons and execution styles. Equity Delivery Brokerage. It is not required to issue cheques by investors while subscribing to IPO. Suppose a trader employs scalping to profit off price movements for ABC stock trading for $10. StoneX One accounts opened through StoneX Securities Inc. Written by Sam Levine, CFA, CMTEdited by Carolyn KimballFact checked by Steven HatzakisReviewed by Blain Reinkensmeyer. Armaan is the India Lead Editor for Forbes Advisor. Simplify your workflow and trade faster with REDI EMS. To trade options, you’ll also need a brokerage account that’s approved for options trading. What is Trade and Carry.

Robustness Testing

There is a third type of trading strategy that has gained prominence in recent times. Find the methodology Forbes Advisor India uses to evaluate and choose the right forex trading company. Connect with our experts today, receive personalized guidance and recommendations for buying Best Workstations for Stock Trading and get other related queries answered. First, it will help you be patient enough to trust the process. Explore this further with NerdWallet’s investment calculator. There are many different trading styles, including day trading, swing trading, and position trading. Good to know: The crypto offering available in the Robinhood brokerage app has limitations. The golden cross is a bit unlike some of the chart patterns we’ve already mentioned in that it requires two moving averages. “Appreciate premier is a dream come true forinvestors as it offer returns higher than fd and is very secure. This site is designed for U. Get ahead of the learning curve, with knowledge delivered straight to your inbox. Similar to momentum trading, swing trading generates capital gains through short term investment strategies. ETF trading prices may not necessarily reflect the net asset value of the underlying securities. While future and options trading offers potential rewards, it comes with inherent risks that demand caution and diligence. The goal of the swing trader is to capture a portion of any potential price movement or “swing” in the market. The bullish engulfing pattern indicates that buyers have taken control, and the price will likely go up. For a more detailed version of how I review the platforms, please refer to this page. Nearly 100 years later, it’s an approach still used by successful traders and one echoed by the many interviewees in Schwager’s book. Since the beginning I have found this to be an issue. To talk about opening an account. This is called the Pattern Day Trading PDT rule. Client Registration Documents Rights and Obligations, Risk Disclosure Document, Do’s and Don’ts in Vernacular Language: BSE NSE.

Is paper trading good for beginners?

Nomura said its decision was for “commercial purposes”. This means the wedge is a reversal pattern as the breakout is opposite to the general trend. Hantec Markets use cookies to enhance your experience on our website. Apple iOS and Android. A market order is executed at the best price available, with no price guarantee. Use profiles to select personalised advertising. Zero commission fees for stock, ETF, options trades and some mutual funds; zero transaction fees for over 3,400 mutual funds; $0. Margin FX trading is one of the riskiest investments you can make. Use limited data to select content. Advanced quotes and research contain 50 columns of data in a very similar format to the desktop platform. That could mean locking in losses and still having to repay the money you borrowed.

Cons:

Investing involves risks, including loss of principal. There are three main types of gaps: Breakaway gaps, runaway gaps, and exhaustion gaps. If it does what you expect and the option’s premium rises as a result, you’d be able to profit by selling your option before expiry. Index funds have defined periods of rebalancing to bring their holdings to par with their respective benchmark indices. With the insights shared in this article traders are better prepared to view leverage not as a tactic but as a tool, in their trading arsenal—one that needs to be finely tuned to match market rhythms and personal financial objectives. Instead, they can access multiple stock exchanges from any location around the world. They protect capital and ensure the capital is available to trade new setups. Exercising does not involve any shares, but rather the cash difference is settled since you can’t buy/sell shares of an index directly. Investments in the securities market are subject to market risks, read all the related documents carefully before investing. Issued in the interest of Investors. This influences their future buying and selling decisions. How long does it take to load. Free of Cost: Did we say it’s all for free. LEAN can be run on premise or in the cloud. M1 Finance Review 2024. It’s a great idea to learn about investing, it can only help with your future finances. Use profiles to select personalised advertising. Any investment that you’ve held for less than a year is taxed in India as ordinary income up to 15%, depending on your RBI income tax bracket versus a lower, long term capital gains rate for investments you’ve owned for more than a year. In our 2024 Annual Awards, ETRADE once again ranked among the best because its apps are easy to use and feature rich. “Margin trading is for experts who understand the mechanics of it — not your average retiree,” says Ricciardi. This is the all important price level. He has a Bachelors’ in Electronics and Telecom Engineering from VESIT Mumbai University, an MBA from NTU Singapore and a Graduate Certificate in Public Policy from The Takshashila Institution. Being aware of your personal investment experience and educational opportunities can also help match you to the right trading platform.

FOR INVESTORS

The platform is headquartered in Seychelles, with a growing number of users in Asia, Europe, the Middle East and Africa. Bajaj Financial Securities Limited is not a registered Investment Advisory. Weekly Market Insights 28 June. A double top is a pattern for two successive peaks, which may or may not be of the same price levels. I Items that will not be reclassified to profit or loss. All content on ForexBrokers. All trading involves risk. Upstox Pro is one of the biggest trading applications in India, owned by Upstox. This would result in additional revenue of US$3. In other words, don’t convince yourself that you’re right.

Gamma Scalping Option Strategy on TRADETRON

That is why we are passionate about helping others build and grow successful apps. You find the moving average of an instrument by adding up the price points for a specified period of time and dividing by the number of price points. Options Clearing Corporation Expiration Calendar. This article briefly examines how you can learn the ropes of the share market when you’re just starting. This site is designed for U. The tight trading range indicates indecision in the market as it cools off from unsustainable buying or selling pressure. This counts as a day trade because you bought and sold the same stock within a single trading day. Bajaj Finance Limited also reserves the exclusive rights to change any of the above mentioned terms and conditions without prior notice to clients. Unlike intraday trading, you have ownership of these shares till you sell them. Some platforms like eToro and Trading 212 have low minimums around $200, while others like Interactive Brokers and Saxo Bank may require $2,000 or more. A type of day trading where traders make short duration trades to leverage price swings. The platform also offers a demo account for users to try out the platform before investing real money. You can trade using a broker’s forex demo account which will allow you to test the different fees and accounts available. As a writer, Michael has covered everything from stocks to cryptocurrency and ETFs for many of the world’s major financial publications, including Kiplinger, U. Tomohiro Ohsumi / Getty Images. Frederick says to think of options like an insurance policy: You don’t get car insurance hoping that you crash your car. Disclosure: The comments, opinions, and analyses expressed on Investopedia are intended for informational purposes online. Swing trading, as the name suggests, is a game of swinging from buying to selling, at lows and highs for a relatively shorter period – usually from a few days to a few weeks. Join Telegram Channel: On the dashboard, click on the task rewards tab, tap on the join button, and join the Telegram channel to see Rs. The double bottom is characterized as two bottoms at an equal or similar price level. Futures and options trading frequently employ candlestick charts. CFDs are complex instruments. Vraj Iron and Steel Ipo.

Learn to trade

Let’s see what that means in an example. Knowing how to read and analyze these common candlestick patterns helps you make informed trading decisions and minimize risks. Also, because the spot cash forex markets are so large and liquid, the ability to enter and exit a trade at the desired level is much easier than in other less liquid markets. The corrective phase is BC and it posed overhead resistance to an advance. As the stock’s value approaches the trendline and commences an upward trajectory, this juncture offers a potential entry point. Stock trading apps are generally safe to use. You can get started investing with very small amounts these days. Now let’s look at how to do it correctly, so you can get the most benefit from it. Numerous studies show that when the retail investor engages in impulse investing and frequent trading he or she ends up with lower than average returns. Regardless of the products or markets being traded, risk is important to understand for all day trading beginners. The following seven currency pairs—what are known as the majors—account for about 75% of trading in the forex market. While indicators can provide valuable insights, interpreting them correctly is key to successful trading. The pattern is invalidated and downside potential resumes on a drop below the double bottom lows. “KYC is one time exercise while dealing in securities markets once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. Using your financial data concisely, you can track and compare your – sales, profitability and expenses across years, months and quarters. I Items that will not be reclassified to profit or loss. Cryptocurrencies are an alternative to traditional money. Losing is as much part of trading as winning. Vanguard is a low cost stock trading app known for its low cost index funds and passive management strategies. One of the most reliable and safe option of investing is Trinkerr. This is known as a bullish crossover in technical analysis and often indicates an upward price trend. This makes it a valuable tool for traders looking to capitalize on potential upward price movements. The data would be provided to the clients on an “as is” and “where is” basis, without any warranty. Driving profitability with your trading strategy requires discipline and a systematic approach. Store and/or access information on a device. Most brokerage accounts are protected by the Securities Investor Protection Corporation, or SIPC. Understanding the psychology behind the peaks and troughs is essential for successful M pattern trading. Wealthfront’s industry best automated portfolio management, goals based asset allocation, and access to banking and investing tools make it well suited for investors seeking the best automated investment experience. ” from the movie “Jerry Maguire”.